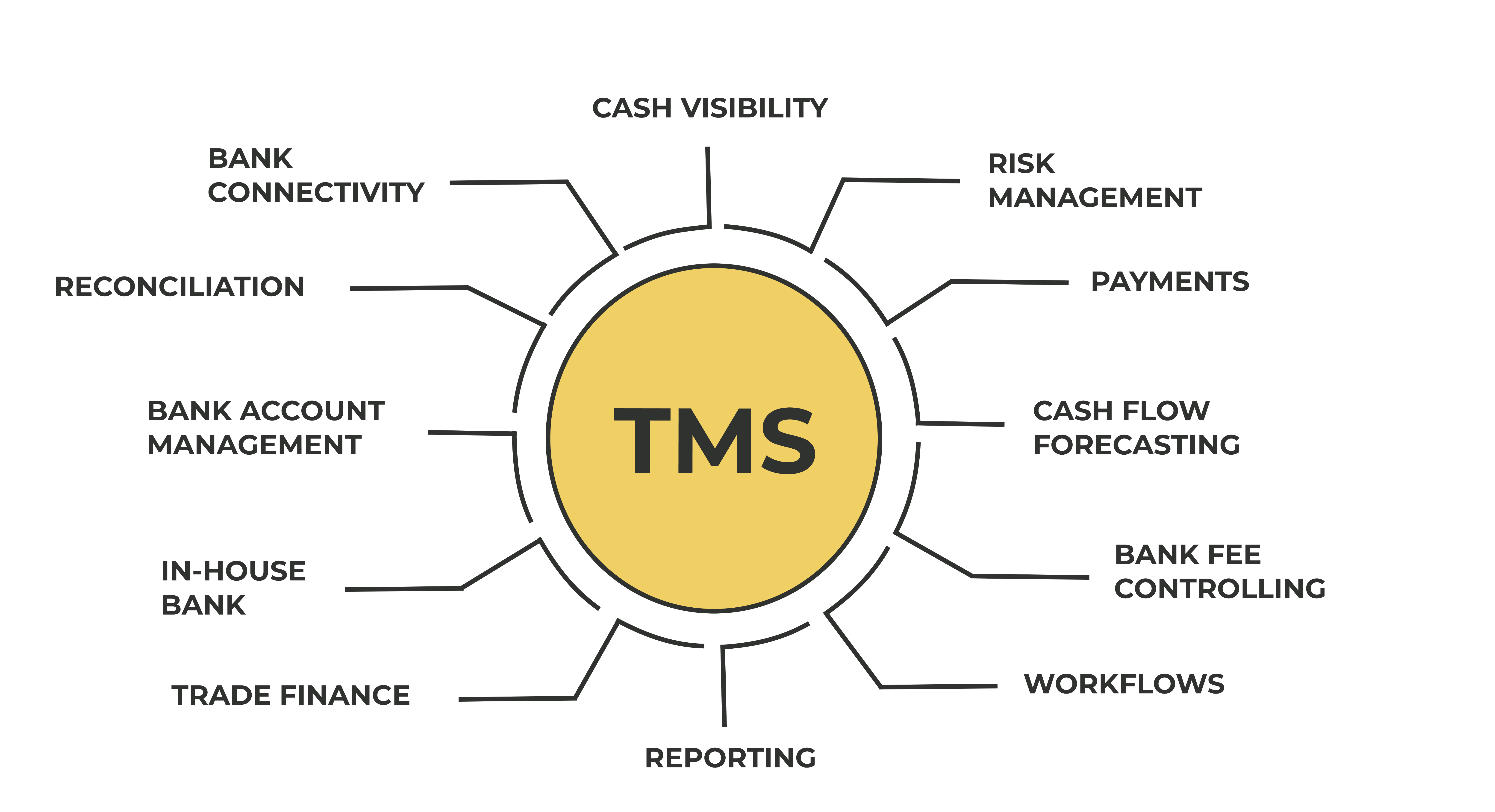

Top Treasury Management System (TMS) Features

In today's volatile economic landscape, are businesses truly equipped to navigate the complexities of financial management? The answer lies in robust treasury management systems (TMS), which are no longer a luxury but a necessity for sustained growth and stability. These sophisticated solutions empower organizations to take control of their financial destinies, optimizing cash flow, mitigating risks, and making data-driven decisions.

Treasury management has evolved significantly, moving beyond basic accounting software to encompass a holistic approach to financial operations. A modern TMS provides real-time visibility into cash positions across all accounts, enabling businesses to forecast future needs and proactively address potential liquidity issues. This enhanced control allows for strategic allocation of resources, informed investment decisions, and ultimately, a stronger financial foundation.

| Area | Details |

|---|---|

| Expertise | Treasury Management, Financial Technology, Corporate Finance |

| Experience | 10+ Years in Financial Journalism and Analysis |

| Current Role | Contributing Writer/Analyst at Major Financial Publications (Hypothetical) |

| Education | MBA in Finance, CFA Charterholder (Hypothetical) |

| Publications | Numerous articles and reports on Treasury Management, Fintech, and related topics. |

| Reference | Association for Financial Professionals (For general industry information - not a specific reference to the hypothetical individual.) |

A critical feature of a robust TMS is its ability to integrate seamlessly with other enterprise resource planning (ERP) systems. This integration centralizes accounts payable and receivable processes, streamlining workflows and eliminating data silos. The result is improved accuracy, reduced manual errors, and enhanced efficiency across the entire financial ecosystem. Modern systems also incorporate compliance tools, ensuring adherence to regulatory requirements and minimizing financial risk.

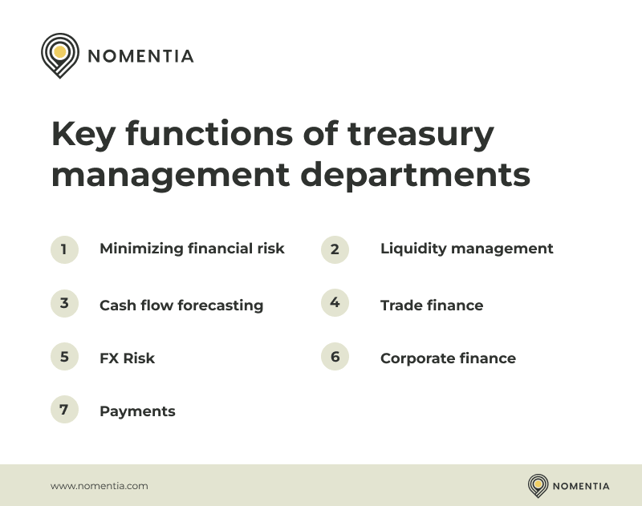

Choosing the right TMS requires a thorough understanding of your organizations specific needs and financial objectives. Key features to consider include: comprehensive cash flow forecasting, robust liquidity management tools, multi-currency support, automated payment processing, and advanced analytics capabilities. A well-designed TMS empowers treasury professionals to make informed decisions based on real-time data, optimizing working capital and maximizing profitability.

From cash flow management to risk mitigation, a TMS covers all aspects of an organization's financial health. Cash flow management, the cornerstone of treasury operations, involves precise tracking and forecasting of inflows and outflows. Liquidity management ensures that sufficient funds are available to meet short-term obligations, while risk management focuses on identifying and mitigating potential financial, regulatory, and operational risks. By addressing these key components, a TMS strengthens the organization's financial backbone and sets the stage for long-term success.

The market offers a wide range of TMS solutions, from standalone applications to comprehensive platforms. Some solutions specialize in specific areas, such as cash forecasting or receivables management, while others offer a full suite of treasury functionalities. It is essential to evaluate different options and select a system that aligns with your organization's size, industry, and specific requirements. Beyond core functionalities, consider factors such as scalability, user-friendliness, and vendor support.

While some enterprise receivables platforms might include basic cash forecasting, they often lack essential treasury management features such as banking solutions, credit offerings, working capital options, and accounts payable functionality. A true TMS provides a centralized platform for managing all aspects of treasury operations, going beyond simple receivables management to encompass a holistic view of financial health. This comprehensive approach empowers businesses to optimize their financial performance and achieve sustainable growth.

The instruments of effective treasury management extend beyond software. They encompass a range of tools and strategies, including hedging strategies to mitigate currency risk, investment vehicles for maximizing returns, and sophisticated payment and collection systems. These tools can be deployed as standalone solutions or integrated within a comprehensive TMS. Key features of a robust TMS include centralized financial management, multi-currency support, automated tasks, advanced analytics, and real-time reporting. These features empower treasury professionals to make data-driven decisions, optimize working capital, and enhance financial performance.

In conclusion, the right treasury management system is more than just software; it's a strategic investment in your organizations financial future. By providing real-time visibility, enhanced control, and advanced analytics, a TMS empowers businesses to navigate the complexities of the modern financial landscape and achieve sustainable growth. It is an essential tool for any organization seeking to optimize cash flow, mitigate risks, and build a strong financial foundation for the future.