Understanding FIFO (First In, First Out) Method

In the intricate dance of commerce and accounting, where precision reigns supreme, does your business truly grasp the power of effective inventory management? FIFO (First-In, First-Out) isn't just an accounting method; it's a strategic lever that can significantly impact your bottom line, minimize waste, and optimize resource allocation.

FIFO, at its core, is elegantly simple. Imagine a stack of pancakes. The first pancake made is the first one eaten. This same principle applies to inventory. The items first added to your stock are assumed to be the first ones sold. This seemingly straightforward concept has profound implications for how businesses track costs, manage their stock, and ultimately, project profitability. It's a system that resonates with the natural flow of goods in many businesses, ensuring that older inventory is moved before it becomes obsolete or loses value, particularly crucial in industries dealing with perishable goods or rapidly changing trends.

| Concept | First-In, First-Out (FIFO) |

| Definition | An inventory valuation method where the oldest items in inventory are assumed to be sold first. |

| Application | Inventory accounting, cost of goods sold (COGS) calculations, stock management |

| Benefits | Reduces waste from obsolescence, simplifies inventory tracking, aligns with the natural flow of goods in many industries. |

| Impact on Financials | Affects COGS, gross profit, and net income calculations. In periods of rising prices, FIFO can lead to higher reported profits compared to other methods. |

| Example Industries | Food and beverage, fashion, electronics, pharmaceuticals. |

| Further Reading | Investopedia: FIFO |

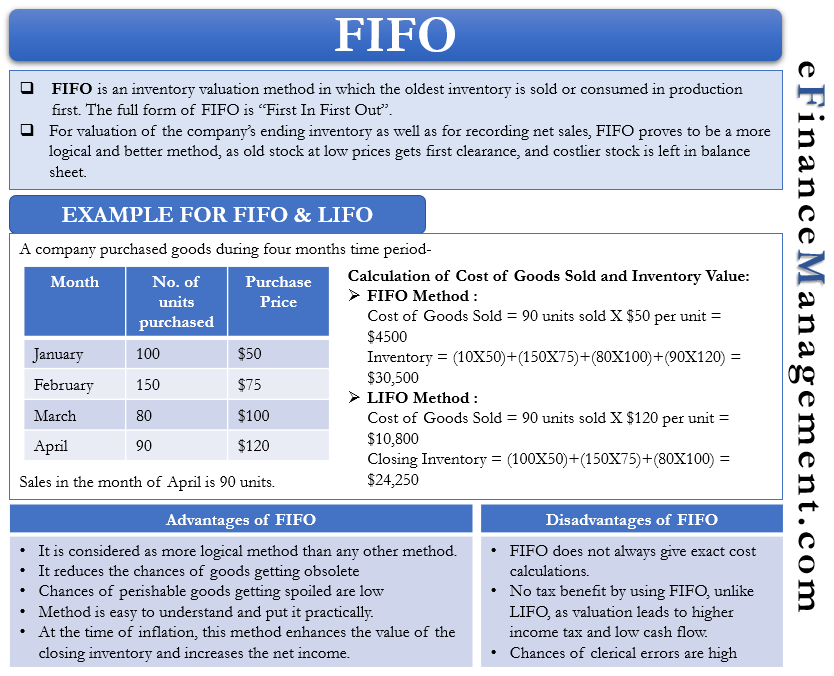

The implications of choosing FIFO extend far beyond mere bookkeeping. In periods of rising prices, FIFO can lead to higher reported profits. This is because the cost of goods sold (COGS) reflects the older, lower costs of inventory, while the remaining inventory on hand carries a higher value. Conversely, during periods of falling prices, FIFO can result in lower reported profits. Understanding these dynamics is critical for informed decision-making and accurate financial forecasting.

Beyond the financial statements, FIFO fosters operational efficiency. By prioritizing the movement of older stock, businesses minimize the risk of obsolescence and spoilage. This is particularly relevant for businesses dealing with perishable goods, such as food and pharmaceuticals. Imagine a grocery store managing its dairy products. Using FIFO ensures that milk with earlier expiration dates is sold first, reducing waste and maintaining product quality.

However, FIFO isn't a one-size-fits-all solution. Businesses operating in environments with fluctuating prices need to carefully consider the impact on their financial reporting. In certain situations, alternative methods like LIFO (Last-In, First-Out) might be more appropriate, especially for businesses dealing with non-perishable goods or raw materials whose prices fluctuate significantly. The key is to choose the method that most accurately reflects the economic realities of the business and provides the most meaningful financial insights.

Implementing FIFO effectively requires robust inventory tracking systems. Accurate record-keeping of purchase dates and costs is crucial. Modern inventory management software can automate much of this process, providing real-time visibility into stock levels and simplifying the application of FIFO. Investing in such systems can significantly improve operational efficiency and reduce the administrative burden of manual tracking.

In the competitive landscape of today's market, strategic inventory management is a non-negotiable element of success. FIFO offers a clear, logical, and often highly effective approach. By embracing the "first in, first out" principle, businesses can enhance financial accuracy, minimize waste, optimize resource allocation, and ultimately, strengthen their competitive edge. It's about more than just accounting; it's about smart business.

Consider the example of Bike Ltd., which purchased 10 bikes in January and sold 6. Using FIFO, we can precisely track the cost of goods sold and the value of remaining inventory. This detailed tracking allows for accurate profit calculation and informed purchasing decisions going forward. Its a practical demonstration of FIFO's utility in a real-world scenario.

Landing a job in an environment that utilizes FIFO principles requires more than just applying; it requires a strategic approach. Understanding the nuances of FIFO and its implications for inventory management demonstrates a deeper understanding of business operations, making you a more desirable candidate. It showcases your ability to think strategically about resource allocation and cost management.

Whether you're managing data flows in complex systems or tracking the flow of physical goods in a warehouse, FIFO principles remain relevant. They provide a structured approach to managing resources, ensuring efficient processing and minimizing the risk of data loss or product obsolescence. FIFO, in its various applications, offers a powerful framework for optimizing processes and maximizing value.

The "first in, first out" method, whether applied to data or physical inventory, is more than just a procedure; it's a cornerstone of efficient resource management. Its widespread adoption across diverse industries speaks to its fundamental value in maintaining order, minimizing waste, and ultimately, driving profitability. It's a principle as relevant to the smallest of businesses as it is to the largest corporations.