Understanding Leverage In Finance: Risks & Rewards Explained

What if I told you that you could potentially amplify your investment returns, or even the growth of your business, simply by strategically using debt? That, in essence, is the power of leverage a powerful tool, but one that demands careful understanding.

Leverage, a term often bandied about in the world of finance and business, holds slightly different shades of meaning depending on the context. However, at its core, leverage represents the strategic use of borrowed funds debt to achieve a specific financial or business objective. It is a fundamental concept, a powerful strategy, yet also one that carries inherent risks. Whether in personal finance, investing, or the operations of a multinational corporation, the underlying principle remains consistent: leverage amplifies the results of an action, either magnifying gains or accelerating losses.

To better understand this multifaceted concept, let's break down its core components and explore the various forms it takes.

| Aspect | Details | Relevance |

|---|---|---|

| Definition | The use of borrowed capital (debt) to increase the potential return on an investment or business venture. | Provides the foundation for understanding how leverage works. |

| Key Components |

| Highlights the mechanics of leverage. |

| Types of Leverage |

| Demonstrates that leverage can be applied in various ways. |

| Benefits |

| Highlights the advantages of using leverage. |

| Risks |

| Explains the downsides of leverage. |

| Applications |

| Showcases how leverage is used in different situations. |

| Ratios and Metrics |

| Outlines the tools used to measure and assess leverage. |

In the realm of investing, leverage takes the form of using borrowed money to amplify the potential results of an investment. This can manifest in various ways, from trading on margin, where investors borrow money from their brokers to purchase securities, to utilizing leveraged Exchange Traded Funds (ETFs), which are designed to deliver multiples of the daily performance of an underlying index. Companies also use leverage to increase the returns on investors' money, offering a way to potentially boost profit.

Trading on margin, a common application of leverage, allows investors to control a larger position with a smaller amount of capital. The allure of this strategy lies in the potential for significant gains. A small percentage increase in the price of an asset can translate into a substantial profit when multiplied by the size of the leveraged position. However, it is crucial to recognize that the leverage effect works in both directions. If the investment performs poorly, losses are also amplified, potentially leading to margin calls, where the broker demands additional funds to cover the losses.

Businesses, similarly, employ leverage as a strategic tool to propel growth and enhance profitability. This can take various forms. Financial leverage, for instance, involves utilizing borrowed capital, often through corporate bonds or loans, to finance operations and generate income. This strategy allows companies to invest in themselves for expansions, acquisitions, or other strategic initiatives without relying solely on equity financing. By strategically deploying debt, companies can potentially increase assets, cash flows, and overall returns. This is especially true when the return on assets exceeds the cost of borrowing.

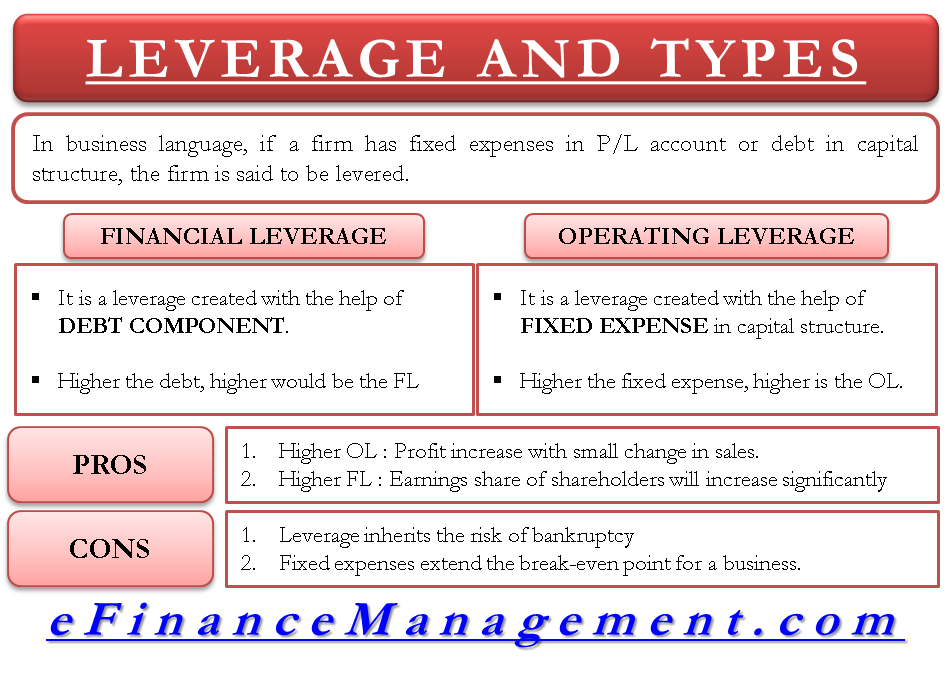

There are three main types of leverage companies can use: financial leverage, operating leverage, and combined leverage.

- Financial leverage is the concept of using borrowed capital as a funding source.

- Operating leverage, on the other hand, is a financial ratio that uses a company's fixed costs relative to its variable costs. This measures the degree to which a firm can increase operating income.

- Combined leverage benefits not only the business owner but also the companys shareholders.

Operating leverage focuses on the structure of a company's cost base. Companies with high operating leverage have a larger proportion of fixed costs relative to variable costs. This can result in higher profitability when sales increase, as the fixed costs are spread across a larger volume of output. However, it also means that profits can fall more rapidly when sales decline, as the fixed costs remain constant, diminishing the profit margin.

Consider the scenario where a business owner needs to acquire an asset to support business operations but lacks sufficient funds. This is where liability or debt can become a valuable tool. By securing a loan or issuing bonds, the business can acquire the asset, generate income, and potentially grow its business.

Leverage is not without its complexities and risks. While it holds the potential to magnify returns, it also carries the risk of amplified losses. In the case of financial leverage, a decline in the value of an asset can lead an investor to lose more than their initial investment. Businesses that employ high levels of debt face increased financial risk, including the possibility of bankruptcy if they are unable to meet their debt obligations. A firm that uses borrowed funds to increase its return on equity incurs the risk that its return on assets is less than the cost of borrowed funds.

Several leverage ratios and metrics are employed to measure the extent to which an entity utilizes borrowed funds. These ratios are essential in understanding the level of risk and the financial health of a company or investment.

Here are the commonly used ratios:

- Debt-to-Equity Ratio: Measures the proportion of debt to equity.

- Debt-to-Assets Ratio: Measures the proportion of debt to assets.

- Other common leverage ratios used to measure financial leverage include:

The debt-to-equity ratio is perhaps the most widely used leverage ratio. It provides insight into the relationship between a company's debt and its shareholders' equity. A higher ratio indicates a greater reliance on debt financing, which can signify higher financial risk. Companies with more debt than the average for their industry are considered to be highly leveraged.

While leverage can be a powerful engine for growth and profit, it demands prudent management. The proper application of leverage involves careful consideration of the risk factors, the cost of borrowing, and the potential for increased returns. It is a double-edged sword that can significantly enhance investment returns when used appropriately, but can also amplify risks if mismanaged. Thorough due diligence, a solid understanding of the financial landscape, and a well-defined strategy are essential for effectively harnessing the power of leverage. It is a crucial concept in investing and finance, influencing the risk and return dynamics of businesses and investments.

In essence, leverage is the art of strategically employing debt to achieve a financial or business goal. It is a tool that, when wielded with skill and prudence, can unlock significant opportunities for growth and profitability, and it is important for anyone that borrows or plans to borrow money to understand.

:max_bytes(150000):strip_icc()/What_Is_Financial_Leverage-2e972f832d4749c9aa5302353cdec52f.jpg)